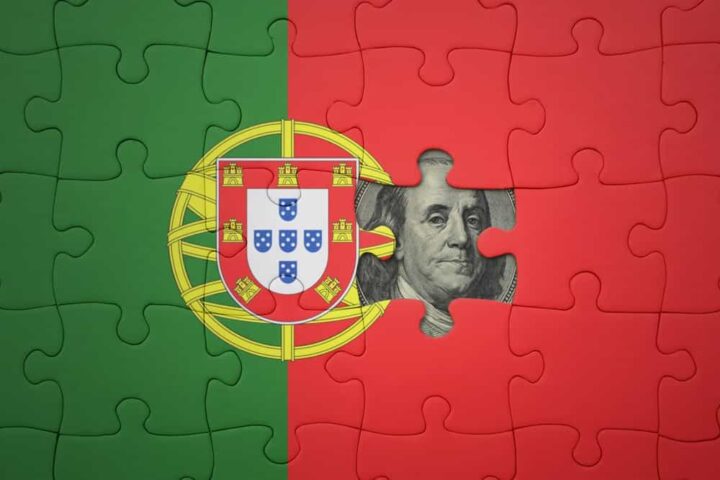

Many Americans dream of moving to Portugal for its sunny climate and rich culture. However, navigating a new country’s tax system is a critical step for financial stability (and legal compliance).

The free guide below offers a clear path through Portugal’s tax system for American expats. It details crucial topics such as residency rules, benefits of the Non-Habitual Resident (NHR) scheme, filing obligations with the Modelo 3 form, and proven strategies to prevent double taxation.

Taxes for Expats in Portugal

An expat’s tax obligations in Portugal are determined by their residency status; residents are taxed on their worldwide income, while non-residents only pay tax on income sourced from within Portugal. The country uses a calendar tax year (January 1 to December 31), and tax returns are due between April 1 and June 30 of the following year.

For the 2025 tax year, Portugal’s progressive tax rates for residents range from 13% to 48%. In contrast, non-residents are subject to a flat tax rate of 25% on most Portuguese-source income.

Portugal also features a Non-Habitual Resident (NHR) scheme, which provides significant tax advantages for up to a decade to new residents who have not been a Portuguese tax resident in the previous five years. The program’s benefits can include a flat 20% tax on certain professional income earned in Portugal and a 10% tax on foreign pension income.

Establishing Tax Residency in Portugal

Portugal defines tax residency using two primary criteria:

- You are considered a tax resident if you spend more than 183 days in the country during a 12-month period; these days do not need to be consecutive.

- You also qualify as a resident if you have a property in Portugal that you intend to use as your habitual home on December 31.

The process begins with obtaining a Número de Identificação Fiscal (NIF) — Portugal’s taxpayer identification number — from the local tax office (Finanças). Your residency status is crucial because it determines whether you are taxed on your worldwide income or only on Portuguese-source income, and it establishes eligibility for the Non-Habitual Resident (NHR) program.

Understanding the Non-Habitual Resident (NHR) Scheme

Portugal’s NHR scheme offers significant tax advantages. To be eligible, you must not have been a Portuguese tax resident in the five years prior to your application. The application for NHR status must be submitted by December 31 of the year following the one in which you become a tax resident.

The new “NHR 2.0” regime, effective from 2024, introduces several key changes to income tax:

- It provides a 20% flat tax rate on Portuguese-source income for those in specific innovative fields, such as research and development or certified startups.

- Foreign pension income is taxed at a flat rate of 10%.

- Most foreign-source income, like dividends and capital gains, can be exempt if it may be taxed in the source country under a Double Taxation Agreement.

The primary benefit is a decade of reduced tax liability on various income streams. A notable limitation is that the new NHR 2.0 scheme is restricted to a narrower list of eligible professions compared to the original program.

Tax Obligations for Expats in Portugal

The primary tax obligation for expats is to file an annual Personal Income Tax (Imposto sobre o Rendimento das Pessoas Singulares, or IRS) return using the Modelo 3 form. Penalties for late filing can range from €25 to €3,750.

Beyond income tax, property owners pay an annual municipal Property Tax (IMI), with rates typically between 0.3% and 0.45% for urban properties. Capital gains from selling real estate are also taxed; residents add 50% of the gain to their income at progressive rates, while non-residents are taxed a flat 28% on the entire gain.

Finally, Social Security contributions are mandatory. Employees contribute 11% of their gross salary, while employers are responsible for a 23.75% contribution.

Tax Benefits and Deductions for Expats

Expats who are residents in Portugal can take advantage of local tax benefits. Residents can claim deductions for certain expenses, including health, education, and pension contributions, which can lower their overall taxable income.

For American expats, the most significant relief comes from U.S. tax provisions. The Foreign Earned Income Exclusion (FEIE) allows you to exclude up to $130,000 (for tax year 2025) of foreign-earned income from your U.S. taxes.

Additionally, the Foreign Tax Credit (FTC) provides a dollar-for-dollar credit for taxes paid to Portugal, which can be used to offset your American tax liability.

Financial Planning Strategies for Expats

A comprehensive financial plan for expats must integrate Portuguese tax obligations with overall retirement and investment goals. This strategy should account for property taxes (IMI) and the Adicional Imposto Municipal Sobre Imóveis (AIMI), a wealth tax on properties valued over €600,000, in your budget.

Proactive tax planning is also essential to fully leverage the benefits available from the NHR scheme and Double Taxation Agreements. Given the complexities, consulting with expat tax services professionals who understand both Portuguese and U.S. taxes for expats in Portugal is crucial for ensuring compliance and optimizing your financial situation.

Avoiding Double Taxation

Double taxation occurs when the same income is taxed by two different countries. For American expats, this creates a potential liability for taxes in both the U.S. and Portugal.

To prevent this, the U.S. and Portugal have a tax treaty that defines which country holds the primary right to tax specific types of income. The agreement also includes a “tiebreaker” rule to determine a single country of tax residence if you qualify as a resident in both nations.

Finally, the U.S.-Portugal Totalization Agreement coordinates Social Security benefits and prevents dual contributions. This ensures you typically pay into the system of the country where you work.

Tax Help for Expats in Portugal

Given the complexities of dual tax systems, working with a specialist ensures you remain compliant and can help develop a sound financial strategy. To optimize your cross-border tax strategy, schedule a free consultation with our tax experts today.